Ethereum Price Prediction: Can ETH Reach $5000 Amid Technical Resistance and Strong Fundamentals?

#ETH

- Technical Resistance Levels: ETH must break above $4,469 (20-day MA) and $4,877 (Bollinger Upper) to maintain momentum toward $5000

- Institutional Adoption Catalyst: Growing ETF holdings and VanEck's 'Wall Street Token' designation provide strong fundamental support

- Market Expansion Potential: Tokenized RWAs could access a $400T traditional finance market, creating long-term value appreciation drivers

ETH Price Prediction

Technical Analysis: ETH Faces Key Resistance Test

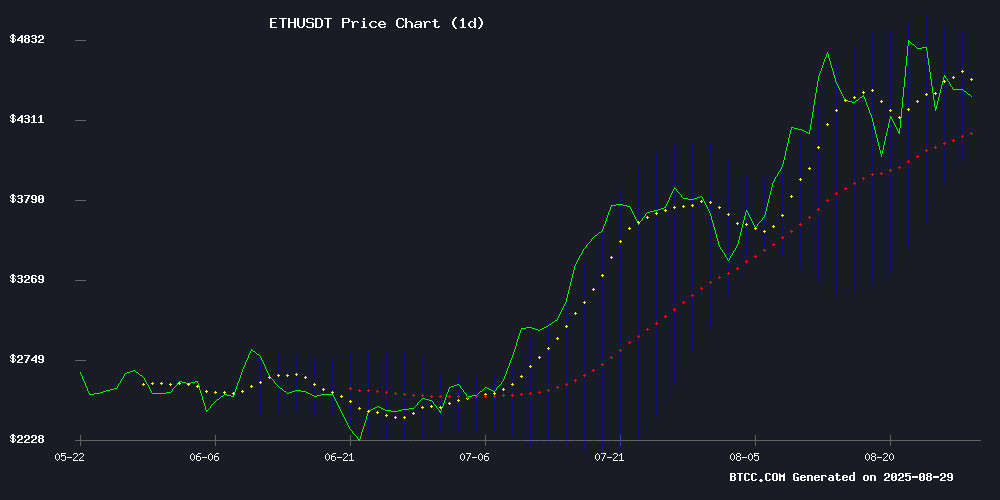

ETH is currently trading at $4,352.58, sitting below its 20-day moving average of $4,469.11, indicating short-term bearish pressure. The MACD reading of -56.26 shows weakening momentum, though the positive histogram of 149.09 suggests some buying interest is emerging. Bollinger Bands position the price NEAR the lower band at $4,060.75, with resistance at the upper band of $4,877.48. According to BTCC financial analyst Ava, 'ETH needs to reclaim the $4,469 level to regain bullish momentum toward the $5,000 target.'

Market Sentiment: Institutional Adoption Offsets Price Concerns

Recent headlines present a mixed but fundamentally strong outlook for Ethereum. While validator concerns and price momentum issues create short-term headwinds, institutional adoption continues to accelerate. ARK Invest's $15.6M BitMine purchase and VanEck's 'Wall Street Token' designation highlight growing institutional confidence. BTCC financial analyst Ava notes, 'The $400T traditional finance market potential through tokenized RWAs provides massive long-term upside, outweighing current technical weaknesses.'

Factors Influencing ETH's Price

Ethereum Faces $5 Billion Validator Exodus as Price Momentum Wanes

Ethereum's rally shows signs of fatigue as the cryptocurrency struggles to hold above $4,550 following rejection at the $4,700 resistance level. The network faces unprecedented selling pressure with over 1 million ETH - valued at $4.96 billion - queued for validator withdrawals, creating the largest staking exodus in Ethereum's history.

Technical indicators reveal weakening momentum. ETH failed twice to breach the $4,630 resistance, with the 100-hour moving average now acting as overhead resistance. The validator exit queue has ballooned to 18 days and 16 hours as participants rush to liquidate positions after ETH's 72% quarterly gain.

Despite the near-term pressure, institutional analysts remain bullish. Standard Chartered maintains its $7,500 year-end price target, viewing the validator exodus as healthy profit-taking rather than structural weakness in Ethereum's proof-of-stake ecosystem.

ARK Invest Expands Crypto Portfolio with $15.6M BitMine Purchase

Cathie Wood's ARK Invest has deepened its commitment to cryptocurrency-related equities, acquiring an additional $15.6 million worth of BitMine shares. The investment raises ARK's total stake in the Ethereum-focused company to over $300 million across three funds: ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF).

BitMine's growing Ethereum holdings, now valued at $7.5 billion, appear to be a key driver behind ARK's strategic move. Despite recent market volatility, BitMine shares have surged 490% year-to-date, outperforming broader crypto market trends. The purchase reinforces ARK's position in blockchain infrastructure plays, complementing existing investments in Coinbase, Robinhood, and Bullish.

Institutional interest in Ethereum ecosystem companies continues to build as traditional finance increasingly recognizes blockchain's disruptive potential. ARK's latest acquisition signals confidence in Ethereum's long-term value proposition, even as regulatory uncertainties persist.

Ethereum Price Rally and the Rise of Remittix: A Dual Narrative in Crypto Markets

Ethereum's price trajectory is capturing institutional attention, with analysts forecasting a surge to $6,500 by year-end. Spot ETF inflows, including a $1 billion single-day spike post-Jackson Hole stimulus, underscore growing confidence. The asset recently notched an all-time high near $4,948, buoyed by macroeconomic tailwinds and corporate treasury adoption. Technical indicators suggest sustained momentum if ETH maintains support above the $4,400-$4,500 range.

Meanwhile, traders chasing exponential gains are diverting capital to Remittix, a utility-focused altcoin touted for 30x potential through 2025. While Ethereum's narrative hinges on institutional adoption, Remittix is carving a niche as an infrastructure play—demonstrating measurable on-chain progress amid the broader market euphoria.

VanEck CEO Dubs Ethereum 'Wall Street Token' as Stablecoin Adoption Surges

VanEck CEO Jan van Eck has rebranded Ethereum as the "Wall Street token," citing its accelerating adoption by financial institutions amid growing stablecoin utility. The designation follows Ethereum's price rally from April lows of $2,300 to a record $4,953 this week, fueled by regulatory tailwinds and institutional inflows.

Stablecoins are triggering Wall Street's "ChatGPT moment," according to Bitmine's Tom Lee, creating institutional FOMO. Van Eck predicts banks must adopt Ethereum-based blockchain solutions or risk obsolescence in the evolving digital asset landscape. "They'll need to build on Ethereum or chains using its methodology," he told FOX Business.

The GENIUS stablecoin bill's passage and robust demand for U.S. spot Ethereum ETFs underscore the network's rising institutional profile. Ethereum emerges as the clear infrastructure winner in the stablecoin revolution, with its network effects becoming increasingly entrenched in global finance.

Advisors Surpass Hedge Funds as Leading Ethereum ETF Holders

Institutional interest in Ethereum ETFs has reached a pivotal moment, with investment advisors now outpacing hedge funds as the dominant holders. New data reveals advisors control over $1.35 billion in ETH exposure—more than double hedge funds' $688 million stake. This shift signals Wall Street's growing conviction in crypto asset allocation.

Goldman Sachs emerges as the single largest disclosed holder with a $721 million position, followed by Jane Street and Millennium Management. The trend underscores a broader institutional migration into digital assets, with ETH ETFs serving as the primary vehicle.

Tokenized RWAs Could Tap Into $400T TradFi Market, Says Animoca

Animoca Research highlights tokenization as a transformative force in finance, with an addressable market for real-world assets (RWAs) estimated at $400 trillion. Private credit, U.S. Treasuries, commodities, stocks, and bonds are identified as core growth areas. "The sheer scale of the TradFi market underscores the potential for RWA tokenization," researchers Andrew Ho and Ming Ruan noted in their August report.

Tokenized assets have surged to a record $26.5 billion, up 70% since January 2025, according to RWA.xyz. Private credit and Treasuries dominate, accounting for nearly 90% of the tokenized value. Ethereum leads the ecosystem with a 55% share on its base layer, expanding to 76% when including layer-2 networks like Polygon and Arbitrum. Liquidity, security, and developer activity cement Ethereum's position, though emerging blockchains aim to challenge its dominance.

Animoca has entered the fray with its NUVA marketplace, betting that platforms controlling the full lifecycle of tokenized assets will gain a long-term edge. Interoperability between blockchains is poised to be a critical factor in the sector's evolution.

Will ETH Price Hit 5000?

Based on current technical indicators and market developments, reaching $5000 presents both challenges and opportunities. The price must overcome immediate resistance at the 20-day MA of $4,469 and then break through Bollinger Band resistance near $4,877. However, strong institutional adoption through ETF holdings and the potential of tokenized real-world assets creating a $400T market opportunity provide fundamental support. BTCC financial analyst Ava suggests: 'While short-term technicals show weakness, the institutional narrative remains powerfully bullish. A break above $4,877 could open the path to $5000, likely requiring 2-3 months of sustained bullish momentum.'

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $4,352.58 | Below 20-day MA |

| 20-day MA Resistance | $4,469.11 | First major hurdle |

| Bollinger Upper | $4,877.48 | Critical breakout level |

| Target | $5,000.00 | Psychological benchmark |